UAE +971 56 1 55 44 66 – Kuwait +965 51 38 38 68 – Oman +968 92827852

UAE +971 56 1 55 44 66

Kuwait +965 51 38 38 68

Menu

UAE +971 56 1 55 44 66 – Kuwait +965 51 38 38 68 – Oman +968 92827852

UAE +971 56 1 55 44 66

Kuwait +965 51 38 38 68

Elevate Your Career with the Premier CMA course in Middle East & India. Join Now and Unleash Your Financial Excellence

By the end of the training, you will:

At Infinity, we’re redefining what it means to prepare for the CMA. Our high-impact programs are designed for ambitious professionals across the Middle East who want more than just a certification — they want to become true leaders in management accounting. With strategic offices in Kuwait and the UAE, we’re perfectly positioned to bring world-class training and local insight straight to you, wherever you are in the region.

We’re also honored to be officially recognized by the Institute of Management Accountants, USA (IMA USA) as an approved CMA course provider. This endorsement puts Infinity among an elite group of IMA-approved training centers, giving you complete confidence that your course is crafted by experts and aligned with global standards.

What makes us different? It’s the way we blend exceptional guidance with tailor-made resources. Our dedicated team of advisors and mentors partners with you every step of the way, providing customized study materials and hands-on training that go far beyond textbooks. We prepare you not just to pass the CMA exam, but to tackle real-world challenges with skill and confidence.

At Infinity, we don’t settle for simply teaching. We shape futures. If you’re ready to gain a professional edge in management accounting — and to stand out across the Middle East — your journey starts here. Let’s build your success story together.

Discover how our CMA courses across the Middle East empower driven professionals to become global leaders in finance. Each success story reflects the dedication, expert mentorship, and trusted training approach that define Infinity’s proven path to CMA excellence.

CMA HOLDER

CMA HOLDER

CMA HOLDER

CMA HOLDER

CMA HOLDER

CMA HOLDER

CMA HOLDER

CMA HOLDER

CMA HOLDER

CMA HOLDER

CMA HOLDER

CMA HOLDER

In our CMA course, we provide a comprehensive learning experience that blends expert-led instruction, tailored study resources, and practical training — all designed to help professionals throughout the Middle East excel in management accounting and achieve global certification.

Extensive CMA Training Offered in Both Online and In-Person Formats.

Carefully Crafted Study Resources Tailored for Maximizing Exam Achievement.

Reserved Entry to Archived Class Recordings through a Secure Online Portal.

Vast Question Bank with More Than 4,000 Practice Questions.

Hock USA access that includes the full suite of study resources: textbooks, question bank, essay questions, mock tests, and the exam simulation.

Exclusive Discounts on Course Registration Costs.

Nothing showcases the power of our CMA courses across the Middle East better than the inspiring journeys of our graduates. Their remarkable career leaps, international opportunities, and personal triumphs reveal just how life-changing our programs can be — giving you the clarity, skills, and confidence to start your own CMA success story with Infinity.

His qualifications, including CMA, IFRS, FMVA, PMP, and PDGCA, underscore his expertise, complemented by 15 years of hands-on professional experience. His profound understanding enables the development of exceptionally potent study materials, comprehensively encompassing all essential topics, guaranteeing you acquire a thorough and comprehensive grasp of the CMA exam content.

During his CMA USA Training, the primary emphasis lies in equipping you with the essential tools and resources necessary for a smooth CMA exam success journey. Meticulously created study notes and materials have consistently demonstrated their exceptional effectiveness, propelling hundreds of students in Kuwait and across the globe toward attaining their CMA designation. With his materials serving as your trusted companion, you can approach your journey with confidence, knowing you possess all the vital elements for a successful outcome.

Abdul Nasar K Kuni

CMA – IFRS – FMVA – PMP -PGDCA

The CMA credential is globally recognized and imparts crucial skills in management accounting and financial management. CMA certification holders are distinguished for their remarkable expertise in vital accounting domains, encompassing financial planning, cost analysis, financial control, decision support, and upholding professional ethics.

By emphasizing the integration of top-tier competencies from financial planning, analysis, control, decision support, and professional ethics, CMA certification cultivates a highly skilled workforce. To attain this certification, candidates must successfully complete two meticulously crafted examinations.

The scope of CMA is expansive and impressive, laying the groundwork for a promising career. Upon achieving CMA certification, students open doors to a multitude of job opportunities. They can explore various roles within any business, including but not limited to:

Corporate controller

Financial analyst

Management accountant

Senior accountant

Financial risk manager

Anyone can initiate the CMA journey, take the exam, and achieve a passing score. However, to attain the CMA certificate, certain requirements must be met.

CMA examinations are computer-based and conducted at numerous Prometric Test Centers globally. With three testing windows available each year, you have the flexibility to take the exam at a location and time that suits your convenience.

For those actively enrolled in the CMA program and prepared to take the exam, the following steps should be followed:

Candidates have the option to take the CMA exam in-person at a Prometric Test Center (refer to Remote Proctoring FAQs for details). If you decide to reschedule or cancel an appointment within 30 days of the scheduled date, a rescheduling fee must be paid to Prometric. According to Prometric’s policy, exam appointments must be canceled at least 72 hours (3 days) prior to the exam date. It’s important to note that appointments cannot be shifted to a different testing window further in the future.

The trainer will present an effective approach to managing multiple-choice questions (MCQs), especially in examinations like the CMA. You may often find that MCQs encompass a vast amount of information, some of which may not even be relevant to the subject at hand. This can be confusing and lead to time inefficiency.

The fundamental concept here is to commence by reading the actual question located at the end of the provided information, before delving into the options or even the supplementary details presented at the beginning. Here’s the step-by-step process:

The instructor highly advises implementing this strategy during your practice papers and mock exams. The greater your practice, the more seamlessly it will integrate into your routine, ultimately leading to improved performance in the actual examination.

The concept here involves systematically tackling the 100 MCQs in stages, categorizing them by difficulty levels. Instead of merely flagging questions, we will utilize the “Review Incomplete” feature.

• First Pass: Begin by addressing questions you have confidence in.

To qualify for the essay section, candidates must achieve a minimum score of 50% in the multiple-choice section.

The combined scores from both the multiple-choice and essay sections are used to determine whether the candidate passes the exam.

The examinations are computer-based and are available at Prometric testing centers across a network.

The CMA exam employs a scaled scoring system, with scores falling within a range of 0 to 500. To successfully pass each section of the CMA exam, candidates must achieve a minimum score of 360 or higher.

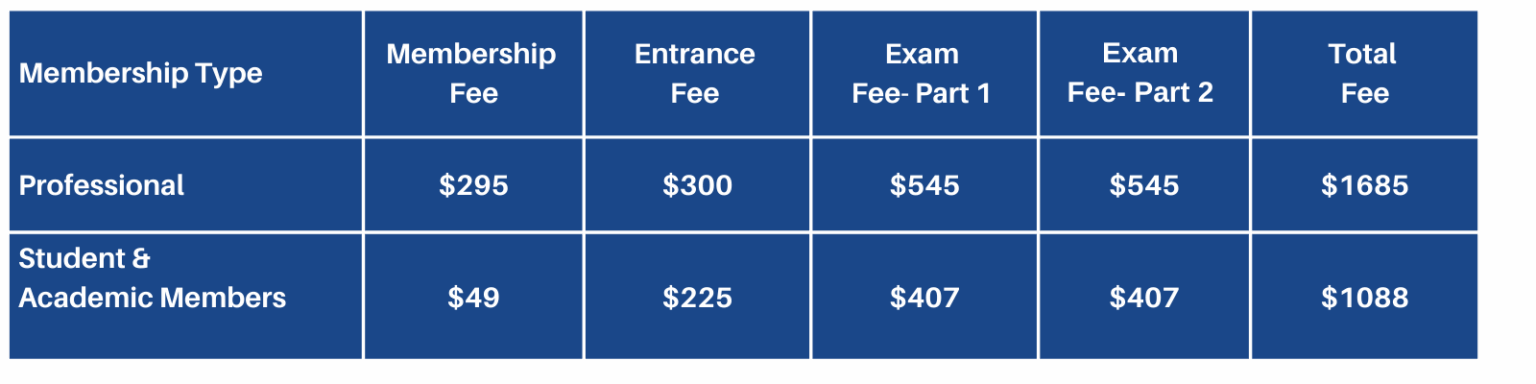

The total CMA exam fee varies depending on your current career stage. Consequently, the breakdown of the CMA exam fee is provided below:

The CMA (Certified Management Accountant) USA is a globally recognized certification for management accountants and financial professionals. It is awarded by the Institute of Management Accountants (IMA) based in the United States.

A bachelor’s degree from an accredited institution and two years of continuous work experience in management accounting or financial management are generally required to become eligible for the CMA exam.

The CMA exam is divided into two parts: Part 1 focuses on Financial Reporting, Planning, Performance, and Control, while Part 2 deals with Financial Decision Making.

The total cost can vary but generally includes IMA membership fees, entrance fees for the CMA program, and exam fees. It can range from $1,000 to $3,000, depending on various factors.

Yes, the CMA USA certification is recognized in various countries and offers global career opportunities in finance and accounting.

After passing both parts of the CMA exam, fulfilling the education and experience requirements, and paying all necessary fees, you will receive your CMA certification from IMA.

CMA certification opens up roles like Management Accountant, Financial Analyst, Finance Manager, CFO, and various other high-level positions in accounting and finance.

IMA may provide exemptions based on other relevant certifications, but it’s best to check directly with IMA for the most current information.

The work experience requirement can be fulfilled either before taking the exam, within seven years after passing the exam, or a combination of both.

You can verify someone’s CMA certification status by checking the IMA’s online directory or contacting IMA directly.

No, you must answer at least 50% of the multiple-choice questions correctly to unlock the essay questions.

Generally, you will need to provide transcripts or equivalent documents to verify your educational qualifications. Specific requirements may vary, so consult IMA for the most accurate information.

Yes, IMA provides various networking events, online communities, and local chapters where CMA professionals can connect.

While there is no time limit for completing both parts, both must be passed within three years of entering the CMA program to earn the certification.

The recommended study time varies by individual but generally ranges from 100 to 150 hours of preparation for each part of the exam.

Yes, Infinity provides mock tests to help candidates prepare for the exam.

While advanced math skills are not required, a solid understanding of basic financial calculations and statistics will be beneficial.

The CMA USA certification is highly valued by employers worldwide, and it often opens up opportunities for international career moves

No, you must meet the educational and professional experience requirements and pay all applicable fees before you can use the CMA USA designation.

Yes, there are online resources, courses, and practice tests provided by both the IMA and third-party educational platforms like Infinity Training Center.

CMAs are employed across a wide range of industries including manufacturing, services, academia, and the public sector among others.

While software proficiency isn’t tested on the CMA exam, knowing how to use various accounting and financial software can be beneficial in your career.

The IMA and some educational institutions offer scholarships and financial aid opportunities. It’s best to check with the IMA and other relevant organizations for the most current information.

Preliminary results are usually available immediately after completing the multiple-choice section, while final results are typically reported within 6 weeks.

Each part of the CMA exam consists of 100 multiple-choice questions and two essay questions, designed to be completed in a four-hour timeframe.

The CMA USA exam is administered at Prometric testing centers worldwide.

Candidates need to score at least 360 out of 500 on each part to pass the exam.

Generally, it takes 12-18 months to prepare and pass both parts of the CMA exam, although this can vary by individual.

The CMA exams are offered during three testing windows each year: January-February, May-June, and September-October.

Yes, you must complete 30 hours of Continuing Professional Education (CPE) annually and maintain membership with the IMA to keep your certification active.

The average salary can vary widely but is generally higher for professionals with a CMA certification compared to those without it.

IMA offers its own study materials, including the CMA Learning System and online practice tests. Various third-party providers also offer study guides and courses.

While both the CMA and CPA are prestigious accounting certifications, they focus on different areas of accounting and serve different roles within the industry.

The official IMA website is the most reliable source for the latest information on CMA USA certification.

While IMA encourages continuous learning, it’s best to check with them directly about any grace periods or exceptions for fulfilling CPE requirements.

You can reschedule or cancel your exam, but be sure to consult IMA’s guidelines and Prometric’s cancellation policies for any fees that may apply.

It’s advisable to schedule at least a few weeks in advance to ensure availability, especially during peak testing windows.

A CMA certification often leads to greater career opportunities and higher earning potential compared to non-certified counterparts in the same field.

The CMA exams are only offered in English.

Yes, you can retake the exam, but you’ll need to pay the exam fee again and adhere to IMA’s scheduling guidelines.

There is no specific order; you can take either Part 1 or Part 2 first according to your preference and preparation.

The CMA USA is globally recognized and is considered the standard for management accounting, although other countries may have their own CMA programs with different focus areas or requirements.

The CMA USA certification is recognized in both the public and private sectors and can be beneficial for roles in either.

CMA USA holders are expected to adhere to the IMA’s Statement of Ethical Professional Practice, which outlines responsibilities and guidelines for ethical conduct.

Yes, there are online communities, forums, and sometimes local study groups that candidates can join for additional support and preparation.

While the CMA certification is highly valuable in both areas, it is generally more geared toward roles in corporate finance and management accounting.

Yes, a financial calculator is allowed, but there are specific guidelines about which models you can use.

Candidates typically need to complete their work experience requirement within 7 years of passing the exam, although exceptions may apply.

Yes, maintaining an active IMA membership is required to keep your CMA USA certification.