UAE +971 56 1 55 44 66 – Kuwait +965 51 38 38 68 – Oman +968 92827852

UAE +971 56 1 55 44 66

Kuwait +965 51 38 38 68

Menu

UAE +971 56 1 55 44 66 – Kuwait +965 51 38 38 68 – Oman +968 92827852

UAE +971 56 1 55 44 66

Kuwait +965 51 38 38 68

Elevate Your Career with the Premier CMA Training in Qatar! Join Now and Unleash Your Financial Excellence

By the end of the training, you will:

Infinity offers top-notch CMA training in Qatar, catering to professionals aspiring to establish themselves in the realm of management accounting. As a CMA institute, Infinity Training Center has earned an impressive reputation in Qatar, distinguished by an unparalleled pass rate and an exceptional approach to coaching.

Infinity has achieved a noteworthy milestone by securing approval from the Institute of Management Accountants, USA (IMA USA) as a certified CMA course provider. This accomplishment holds substantial significance, as Infinity stands among the select few CMA training centers in Kuwait endorsed by the IMA. The IMA Approved CMA Course Provider program offers the assurance that your chosen training program has been created by knowledgeable and qualified experts. It further guarantees that the course adheres to established standards and guidelines.

At our CMA institute, we take pride in our team of experienced career counselors and mentors who are dedicated to facilitating your successful completion of the course in the most efficient manner possible. Our tailor-made study materials are designed to make a significant positive impact on the journey to success for test takers. Through practical training in CMA concepts and immersive learning in a simulated environment, we empower candidates to develop into real-world problem solvers, ensuring their attainment of passing grades in the exam. At Infinity, we spare no effort in shaping the futures of our enrolled candidates, providing excellent training that will transform you into an industry expert. If you’re in search of a CMA institute, your quest concludes here. Contact us today to discover how our training can propel your career forward.

We’re proud to showcase our students who successfully completed the CMA course and earned their CMA certification. Their success reflects the quality of our CMA training and their hard work. Be inspired by our growing list of CMA passed achievers — your name could be next!

Hearing directly from those who’ve completed our CMA training in Qatar and across the Middle East speaks louder than any promise we could make. Their inspiring stories of career growth, success, and global opportunities highlight the true value of our programs — giving you the confidence to begin your own CMA journey in Qatar with Infinity.

Expert-led coaching for CMA Part 1 & Part 2, covering all essential concepts and exam strategies.

Attend interactive live sessions or learn at your own pace with on-demand recorded lessons.

Get access to 4,000+ MCQs, mock exams, and practice tests after every topic to ensure exam success.

Well-structured, easy-to-understand content designed to help you pass the CMA exam efficiently.

Infinity Training International is an IMA® Approved Course Provider for the CMA USA certification, delivering expert-led training aligned with global standards.

We offer official HOCK International study materials with an exclusive discount for our students.

Infinity is a trusted name for CMA training in Qatar and the rest of the Middle East, backed by years of proven results and expert-led instruction. We combine focused study materials, real exam strategies, and personalized support to ensure student success. With global recognition and local presence, Infinity is your ideal partner in achieving CMA certification.

His qualifications, including CMA, IFRS, FMVA, PMP, and PDGCA, along with 15 years of professional experience, attest to his expertise. His profound knowledge empowers him to develop exceptionally effective study materials encompassing all essential topics, guaranteeing you acquire a comprehensive and well-rounded grasp of the CMA exam content.

At his CMA USA Training, the primary objective is to equip you with the essential tools and resources for a seamless CMA exam journey. The meticulously designed notes and study materials have consistently demonstrated their high effectiveness, facilitating hundreds of students in Kuwait and across the globe to attain their CMA designation. With his materials as your roadmap, you can approach your path to success with unwavering confidence, knowing that you possess all the necessary ingredients for achievement.

Abdul Nasar K Kuni

CMA, IFRS, FMVA, PMP, and PDGCA

The CMA credential is globally recognized for imparting essential skills in management accounting and financial management. CMA certification holders are acknowledged for their commendable expertise in crucial accounting domains, encompassing financial planning, cost analysis, financial control, decision support, and the practice of professional ethics.

By emphasizing the infusion of top-tier competencies from the realms of financial planning, analysis, control, decision support, and professional ethics, the CMA certification program cultivates a highly skilled workforce. To earn this prestigious certificate, candidates must successfully pass two meticulously crafted exams.

The scope of CMA is expansive and noteworthy, laying the foundation for a promising career. Upon achieving CMA certification, students open doors to numerous job opportunities across various sectors of the business world. They can explore a multitude of roles within any organization, including but not limited to:

Corporate controller

Financial manager

Management accountant

Senior accountant

Financial risk manager

While anyone can begin the CMA journey, take the exam, and pass it, obtaining the CMA certificate requires meeting specific qualifications and criteria.

The CMA exams are computer-based and are conducted at numerous Prometric Test Centers across the globe. With three testing windows available each year, you have the flexibility to choose a convenient time and location for your exam.

So, if you are currently enrolled in the CMA program and prepared to take the exam, here are the steps to follow:

Candidates have the option to take the CMA exam in person at a Prometric Test Center (refer to Remote Proctoring FAQs for alternatives). If you decide to reschedule or cancel your appointment within 30 days of the scheduled date, a rescheduling fee must be paid to Prometric. Please note that exam appointments must be canceled at least 72 hours (3 days) before the exam date, adhering to Prometric’s policy.

It’s important to note that appointments cannot be rescheduled to a later testing window.

The instructor will elaborate on an effective strategy for managing multiple-choice questions (MCQs), especially in exams like the CMA. Some of you might have noticed that MCQs often contain a large amount of content, some of which may not even be relevant to the subject being tested. This can be confusing and a time-consuming endeavor.

The fundamental concept here is to commence by reading the question itself, situated at the end of the provided information, before delving into the options or any supplementary information presented at the beginning. Here’s the step-by-step approach:

The instructor highly advises incorporating this strategy into your practice papers and mock exams. With continued practice, it will become increasingly intuitive, ultimately enhancing your performance in the actual exam.

The concept here involves tackling the 100 MCQs in phases, arranging them in order of difficulty. However, instead of marking questions, we will leverage the “Review Incomplete” feature.

• First Pass: Begin by responding to questions you are confident about.

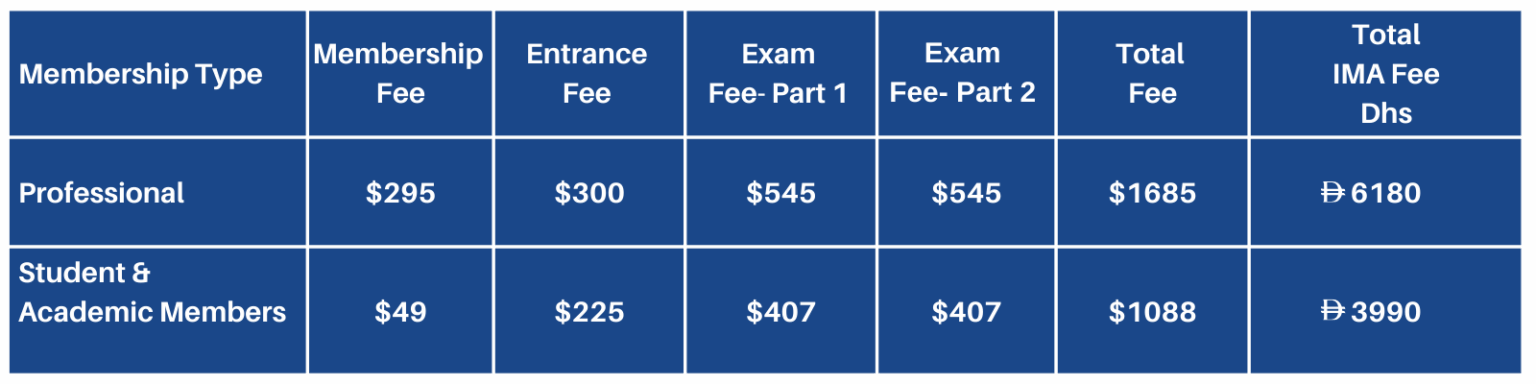

The total CMA exam fee varies according to your career stage. Here are the comprehensive details of the CMA exam fees:

The CMA (Certified Management Accountant) USA is a globally recognized certification for management accountants and financial professionals. It is awarded by the Institute of Management Accountants (IMA) based in the United States.

A bachelor’s degree from an accredited institution and two years of continuous work experience in management accounting or financial management are generally required to become eligible for the CMA exam.

The CMA exam is divided into two parts: Part 1 focuses on Financial Reporting, Planning, Performance, and Control, while Part 2 deals with Financial Decision Making.

The total cost can vary but generally includes IMA membership fees, entrance fees for the CMA program, and exam fees. It can range from $1,000 to $3,000, depending on various factors.

Yes, the CMA USA certification is recognized in various countries and offers global career opportunities in finance and accounting.

After passing both parts of the CMA exam, fulfilling the education and experience requirements, and paying all necessary fees, you will receive your CMA certification from IMA.

CMA certification opens up roles like Management Accountant, Financial Analyst, Finance Manager, CFO, and various other high-level positions in accounting and finance.

IMA may provide exemptions based on other relevant certifications, but it’s best to check directly with IMA for the most current information.

The work experience requirement can be fulfilled either before taking the exam, within seven years after passing the exam, or a combination of both.

You can verify someone’s CMA certification status by checking the IMA’s online directory or contacting IMA directly.

No, you must answer at least 50% of the multiple-choice questions correctly to unlock the essay questions.

Generally, you will need to provide transcripts or equivalent documents to verify your educational qualifications. Specific requirements may vary, so consult IMA for the most accurate information.

Yes, IMA provides various networking events, online communities, and local chapters where CMA professionals can connect.

While there is no time limit for completing both parts, both must be passed within three years of entering the CMA program to earn the certification.

The recommended study time varies by individual but generally ranges from 100 to 150 hours of preparation for each part of the exam.

Yes, Infinity provides mock tests to help candidates prepare for the exam.

While advanced math skills are not required, a solid understanding of basic financial calculations and statistics will be beneficial.

The CMA USA certification is highly valued by employers worldwide, and it often opens up opportunities for international career moves

No, you must meet the educational and professional experience requirements and pay all applicable fees before you can use the CMA USA designation.

Yes, there are online resources, courses, and practice tests provided by both the IMA and third-party educational platforms like Infinity Training Center.

CMAs are employed across a wide range of industries including manufacturing, services, academia, and the public sector among others.

While software proficiency isn’t tested on the CMA exam, knowing how to use various accounting and financial software can be beneficial in your career.

The IMA and some educational institutions offer scholarships and financial aid opportunities. It’s best to check with the IMA and other relevant organizations for the most current information.

Preliminary results are usually available immediately after completing the multiple-choice section, while final results are typically reported within 6 weeks.

Yes, the CMA certification is globally recognized and highly valued across Qatar and the Middle East, especially in sectors like finance, accounting, and management.

Absolutely. Infinity Training International offers flexible online CMA training in Qatar, allowing you to prepare for the exam from the comfort of your home with expert guidance and suppor

Each part of the CMA exam consists of 100 multiple-choice questions and two essay questions, designed to be completed in a four-hour timeframe.

The CMA USA exam is administered at Prometric testing centers worldwide.

Candidates need to score at least 360 out of 500 on each part to pass the exam.

Generally, it takes 12-18 months to prepare and pass both parts of the CMA exam, although this can vary by individual.

The CMA exams are offered during three testing windows each year: January-February, May-June, and September-October.

Yes, you must complete 30 hours of Continuing Professional Education (CPE) annually and maintain membership with the IMA to keep your certification active.

The average salary can vary widely but is generally higher for professionals with a CMA certification compared to those without it.

IMA offers its own study materials, including the CMA Learning System and online practice tests. Various third-party providers also offer study guides and courses.

While both the CMA and CPA are prestigious accounting certifications, they focus on different areas of accounting and serve different roles within the industry.

The official IMA website is the most reliable source for the latest information on CMA USA certification.

While IMA encourages continuous learning, it’s best to check with them directly about any grace periods or exceptions for fulfilling CPE requirements.

You can reschedule or cancel your exam, but be sure to consult IMA’s guidelines and Prometric’s cancellation policies for any fees that may apply.

It’s advisable to schedule at least a few weeks in advance to ensure availability, especially during peak testing windows.

A CMA certification often leads to greater career opportunities and higher earning potential compared to non-certified counterparts in the same field.

The CMA exams are only offered in English.

Yes, you can retake the exam, but you’ll need to pay the exam fee again and adhere to IMA’s scheduling guidelines.

There is no specific order; you can take either Part 1 or Part 2 first according to your preference and preparation.

The CMA USA is globally recognized and is considered the standard for management accounting, although other countries may have their own CMA programs with different focus areas or requirements.

The CMA USA certification is recognized in both the public and private sectors and can be beneficial for roles in either.

CMA USA holders are expected to adhere to the IMA’s Statement of Ethical Professional Practice, which outlines responsibilities and guidelines for ethical conduct.

Yes, there are online communities, forums, and sometimes local study groups that candidates can join for additional support and preparation.

While the CMA certification is highly valuable in both areas, it is generally more geared toward roles in corporate finance and management accounting.

Yes, a financial calculator is allowed, but there are specific guidelines about which models you can use.

Candidates typically need to complete their work experience requirement within 7 years of passing the exam, although exceptions may apply.

Yes, maintaining an active IMA membership is required to keep your CMA USA certification.

Yes, CMA exams can be taken at Prometric testing centers in Qatar, including locations in Doha. You can schedule your exam online through the Prometric website after registering with IMA.